Introduction

Rumble stock represents shares in Rumble Inc., a video-sharing platform that has garnered attention for its commitment to free speech and uncensored content. As an emerging player in the digital media space, Rumble stock has piqued the interest of investors looking for opportunities in the rapidly growing online video market. Understanding the dynamics of Rumble stock, its market performance, and its future potential is crucial for making informed investment decisions.

Rumble stock is not just another tech stock; it embodies the potential for significant growth in an era where content creation and consumption are increasingly shifting to online platforms. By examining the various aspects of Rumble stock, investors can better navigate this promising yet volatile investment landscape.

The History of Rumble

Rumble was founded in 2013 by Chris Pavlovski with the vision of creating a platform that prioritizes content creator freedom and audience engagement. Unlike other video platforms that have faced criticism for content moderation policies, Rumble positioned itself as a haven for free expression. This unique positioning has driven the interest in Rumble stock, making it a potential game-changer in the digital content industry.

The evolution of Rumble stock reflects the platform’s growth and the increasing demand for alternative video-sharing platforms. From its humble beginnings to becoming a publicly traded entity, Rumble’s journey has been marked by significant milestones that highlight its commitment to providing a space for diverse voices.

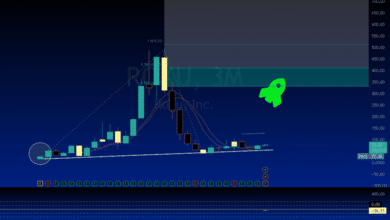

Rumble Stock Market Performance

Rumble stock has experienced a dynamic market performance since its debut. Understanding the factors influencing Rumble stock’s market performance is essential for investors. Market sentiment, industry trends, and company-specific developments all play a role in shaping the trajectory of Rumble stock.

Investors need to monitor Rumble stock’s market performance closely, considering both short-term fluctuations and long-term trends. Analyzing historical data, quarterly earnings reports, and market reactions to new product launches or strategic partnerships can provide valuable insights into Rumble stock’s performance.

Key Factors Influencing Rumble Stock

Several key factors influence the performance of Rumble stock. These include the overall health of the digital content industry, changes in regulatory environments, technological advancements, and shifts in consumer behavior. Additionally, Rumble’s ability to attract and retain content creators and viewers directly impacts the value of Rumble stock.

The competitive landscape also plays a significant role in determining Rumble stock’s success. As new platforms emerge and existing giants like YouTube and Vimeo continue to dominate, Rumble stock’s growth will depend on the company’s ability to differentiate itself and capture market share.

Investment Strategies for Rumble Stock

Investing in Rumble stock requires a strategic approach to maximize returns and manage risks. One common strategy is to adopt a long-term investment perspective, banking on the platform’s potential for sustained growth. Diversifying your portfolio to include Rumble stock alongside other tech and media stocks can also help mitigate risks.

Another strategy involves staying updated on industry trends and company news. Regularly reviewing Rumble’s financial statements, management updates, and market analyses can help investors make informed decisions about buying, holding, or selling Rumble stock. Additionally, understanding the competitive landscape and potential regulatory changes is crucial for assessing the future potential of Rumble stock.

The Role of Free Speech in Rumble’s Appeal

One of the defining characteristics of Rumble is its commitment to free speech, which significantly influences the appeal of Rumble stock. In an era where content moderation practices of major platforms are under scrutiny, Rumble’s stance on uncensored content has attracted a dedicated user base. This commitment to free speech differentiates Rumble from its competitors and enhances the value proposition of Rumble stock.

Investors interested in Rumble stock should consider how this commitment to free speech might impact the platform’s growth and regulatory challenges. While it can attract a loyal audience, it also comes with the risk of regulatory scrutiny and potential legal issues, which could affect Rumble stock’s performance.

Comparing Rumble Stock with Competitors

When evaluating Rumble stock, it is essential to compare it with competitors in the online video platform space. Major players like YouTube, Vimeo, and Dailymotion offer similar services, but each has its unique market position and business model. Understanding how Rumble stock stacks up against these competitors can provide insights into its potential for growth and market share.

Factors to consider when comparing Rumble stock with competitors include user base size, revenue models, content policies, and technological infrastructure. By assessing these aspects, investors can better gauge Rumble stock’s competitive advantages and potential challenges in the market.

Technological Innovations and Rumble Stock

Technological innovations play a crucial role in the success of Rumble stock. The platform’s ability to leverage advancements in video streaming, artificial intelligence, and data analytics can enhance user experience and drive growth. For instance, improved video quality, personalized content recommendations, and robust content moderation tools can attract more users and creators to the platform.

Investors should keep an eye on how Rumble integrates new technologies to stay competitive. Innovations that improve user engagement, streamline content creation, and enhance platform security can positively impact Rumble stock’s value. Additionally, partnerships with tech companies and investments in research and development can further bolster Rumble’s market position.

Future Prospects for Rumble Stock

The future prospects for Rumble stock are tied to the platform’s ability to grow its user base, monetize content effectively, and navigate regulatory challenges. As more users seek alternative platforms that prioritize free speech, Rumble has the potential to expand its market share significantly. Successful monetization strategies, such as advertising, subscriptions, and premium content, will be crucial for sustaining growth.

Investors should also consider the broader industry trends that could influence Rumble stock’s future. The increasing demand for video content, the rise of decentralized platforms, and changes in digital advertising models are all factors that could impact Rumble stock’s growth trajectory. By staying informed about these trends, investors can better anticipate opportunities and risks associated with Rumble stock.

Conclusion:

Investing in Rumble stock offers both opportunities and risks. The platform’s commitment to free speech, coupled with the growing demand for alternative video-sharing platforms, presents significant growth potential. However, investors must also consider the competitive landscape, regulatory challenges, and the need for continuous technological innovation.

Ultimately, whether Rumble stock is a good investment depends on individual risk tolerance, investment goals, and market outlook. By thoroughly researching Rumble stock and staying updated on industry trends, investors can make informed decisions and potentially benefit from the growth of this promising platform.

FAQs

1. What is Rumble stock? Rumble stock represents shares in Rumble Inc., a video-sharing platform known for its commitment to free speech and uncensored content.

2. How has Rumble stock performed in the market? Rumble stock has shown dynamic market performance, influenced by factors such as market sentiment, industry trends, and company-specific developments.

3. What factors influence the performance of Rumble stock? Key factors include the health of the digital content industry, regulatory changes, technological advancements, and Rumble’s ability to attract content creators and viewers.

4. What investment strategies are effective for Rumble stock? Effective strategies include long-term investment perspectives, diversification, staying updated on industry trends, and regularly reviewing financial statements and market analyses.

5. What are the future prospects for Rumble stock? Future prospects depend on Rumble’s ability to grow its user base, monetize content, navigate regulatory challenges, and leverage technological innovations.