Introduction

TSLY stock represents leveraged shares tied to the performance of Tesla, Inc., one of the most innovative and influential companies in the automotive and technology sectors. Investing in TSLY stock allows investors to amplify their exposure to Tesla’s market movements, potentially increasing returns but also introducing higher risk. Understanding TSLY stock is crucial for those looking to make informed investment decisions in the dynamic world of leveraged stocks.

Investing in TSLY stock offers both opportunities and challenges. This comprehensive guide will delve into the various aspects of TSLY stock, from its history and market performance to investment strategies and future prospects. By understanding these factors, investors can better navigate the complexities of TSLY stock and make informed decisions.

The History of TSLY Stock

The history of TSLY stock is closely linked to the rise of Tesla, Inc. Founded in 2003 by Elon Musk and a group of engineers, Tesla has revolutionized the automotive industry with its focus on electric vehicles (EVs), sustainable energy solutions, and cutting-edge technology. TSLY stock was created to provide investors with a leveraged investment vehicle that amplifies the performance of Tesla’s shares.

Understanding the history of TSLY stock involves recognizing key milestones in Tesla’s journey, such as the launch of the Roadster, the introduction of the Model S, and the company’s expansion into energy products like solar panels and battery storage. These developments have driven Tesla’s stock price and, by extension, the performance of TSLY stock.

How TSLY Stock Works

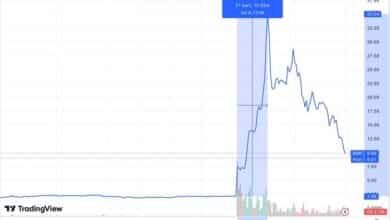

TSLY stock is a leveraged exchange-traded fund (ETF) designed to deliver a multiple of Tesla’s daily performance. Typically, TSLY stock aims to achieve a 2x or 3x return on Tesla’s daily stock movement, meaning if Tesla’s stock price increases by 1%, TSLY stock might increase by 2% or 3%. However, this leverage also means that losses are magnified, making TSLY stock a high-risk investment.

Investors need to understand the mechanics of TSLY stock, including the daily reset feature, which recalibrates the leverage ratio at the end of each trading day. This feature can lead to compounding effects, especially during volatile market conditions. Therefore, TSLY stock is generally more suitable for short-term trading strategies rather than long-term holding.

Market Performance of TSLY Stock

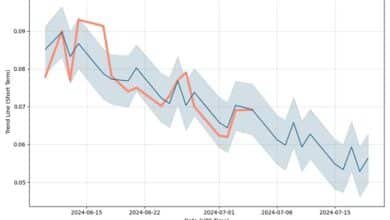

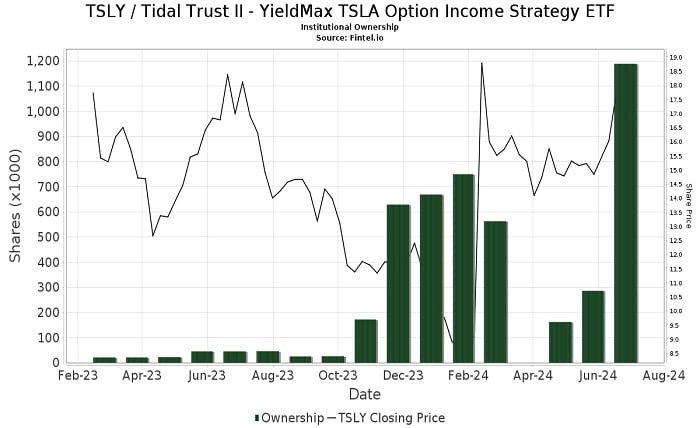

The market performance of TSLY stock is directly tied to Tesla’s stock price movements. Given Tesla’s volatility and significant market movements, TSLY stock can experience substantial price fluctuations. Analyzing the historical performance of TSLY stock can provide insights into its behavior under different market conditions.

Investors should consider factors such as Tesla’s earnings reports, product launches, regulatory changes, and broader market trends when evaluating TSLY stock’s performance. By understanding these influences, investors can better anticipate potential price movements and make more informed decisions regarding their TSLY stock investments.

Key Factors Influencing TSLY Stock

Several key factors influence the performance of TSLY stock, including Tesla’s business performance, industry trends, technological advancements, and macroeconomic conditions. Tesla’s ability to innovate, expand its market share, and navigate regulatory challenges directly impacts TSLY stock.

Additionally, broader trends in the electric vehicle market, such as advancements in battery technology, government incentives for clean energy, and competition from other automakers, can affect Tesla’s stock price and, consequently, TSLY stock. Investors should stay informed about these factors to better understand and predict TSLY stock’s movements.

Investment Strategies for TSLY Stock

Investing in TSLY stock requires a strategic approach due to its leveraged nature. One common strategy is to use TSLY stock for short-term trading, taking advantage of Tesla’s daily price movements to achieve quick gains. This approach involves close monitoring of market conditions and Tesla’s stock performance.

Another strategy is to use TSLY stock as part of a diversified portfolio, balancing the high-risk, high-reward nature of leveraged ETFs with more stable investments. This approach can help mitigate overall portfolio risk while still providing exposure to Tesla’s growth potential. Investors should carefully consider their risk tolerance and investment goals when incorporating TSLY stock into their portfolios.

Risks Associated with TSLY Stock

Investing in TSLY stock carries several risks, primarily due to its leveraged nature. The potential for amplified losses means that even small declines in Tesla’s stock price can result in significant losses for TSLY stock investors. Additionally, the daily reset feature can lead to compounding effects that erode returns over time, particularly in volatile markets.

Another risk is the dependency on Tesla’s performance. Any negative news, such as production delays, regulatory issues, or market competition, can adversely affect Tesla’s stock price and, consequently, TSLY stock. Investors must be prepared for high volatility and the possibility of rapid and substantial changes in their investment value.

Technological Innovations and TSLY Stock

Technological innovations play a crucial role in Tesla’s success and, by extension, the performance of TSLY stock. Tesla’s advancements in electric vehicle technology, battery storage, and autonomous driving capabilities drive investor interest and impact stock price movements. Staying informed about these innovations can provide insights into the future performance of TSLY stock.

Investors should monitor developments such as new vehicle models, improvements in battery efficiency, and progress in Tesla’s Full Self-Driving (FSD) technology. These innovations can significantly influence Tesla’s market position and stock price, thereby affecting TSLY stock. Understanding the technological landscape helps investors make informed decisions about their TSLY stock investments.

Future Prospects for TSLY Stock

The future prospects for TSLY stock are closely tied to Tesla’s growth trajectory and the broader electric vehicle market. As Tesla continues to expand its product lineup, increase production capacity, and innovate in energy solutions, the potential for TSLY stock remains significant. However, investors must also consider potential challenges, such as increased competition and regulatory changes.

Long-term growth in the electric vehicle market, driven by consumer demand for sustainable transportation and government incentives, supports the future prospects of TSLY stock. By staying informed about Tesla’s strategic initiatives and market trends, investors can better anticipate future performance and opportunities for TSLY stock.

Comparing TSLY Stock with Other Leveraged ETFs

When evaluating TSLY stock, it’s essential to compare it with other leveraged ETFs to understand its unique characteristics and potential advantages. Leveraged ETFs differ in their underlying assets, leverage ratios, and investment strategies. Comparing TSLY stock with other similar ETFs can help investors determine the best fit for their investment objectives and risk tolerance.

Factors to consider when comparing TSLY stock with other leveraged ETFs include expense ratios, historical performance, volatility, and liquidity. By understanding these factors, investors can make more informed decisions about incorporating TSLY stock into their investment portfolios and leveraging its potential for enhanced returns.

Conclusion:

Investing in TSLY stock offers both significant opportunities and substantial risks. The potential for amplified returns makes TSLY stock an attractive option for short-term traders and those seeking exposure to Tesla’s growth. However, the leveraged nature of TSLY stock also introduces high volatility and the possibility of significant losses.

Whether TSLY stock is a good investment depends on individual risk tolerance, investment goals, and market outlook. Investors must carefully consider these factors, stay informed about Tesla’s performance and industry trends, and employ strategic investment approaches to navigate the complexities of TSLY stock. With thorough research and prudent decision-making, TSLY stock can be a valuable addition to an investment portfolio.

FAQs

1. What is TSLY stock? TSLY stock represents leveraged shares tied to the performance of Tesla, Inc., designed to deliver a multiple of Tesla’s daily stock movements, typically 2x or 3x.

2. How does TSLY stock work? TSLY stock works by amplifying Tesla’s daily stock price movements through leverage, meaning if Tesla’s stock increases or decreases, TSLY stock experiences a multiplied effect, offering higher potential returns and risks.

3. What are the risks associated with investing in TSLY stock? The primary risks include amplified losses due to leverage, compounding effects from the daily reset feature, and dependency on Tesla’s performance, making TSLY stock highly volatile.

4. How can investors use TSLY stock in their portfolios? Investors can use TSLY stock for short-term trading to capitalize on Tesla’s daily price movements or incorporate it into a diversified portfolio to balance high-risk, high-reward investments with more stable assets.

5. What factors influence the performance of TSLY stock? Key factors include Tesla’s business performance, industry trends, technological advancements, macroeconomic conditions, and regulatory changes, all of which impact Tesla’s stock price and, consequently, TSLY stock.