Introduction

GEV stock refers to the publicly traded shares of Global Energy Ventures Ltd (GEV), a company specializing in the transportation of compressed natural gas (CNG) via marine vessels. As the world shifts towards cleaner energy solutions, GEV stock has garnered interest from investors looking to capitalize on the growing demand for sustainable energy transportation. Understanding the nuances of GEV stock, including its market performance, investment strategies, and future prospects, is essential for making informed investment decisions.

Investing in GEV stock is not just about supporting a company in the energy sector; it also involves recognizing the potential for substantial growth as global energy needs evolve. This comprehensive guide will delve into the various aspects of GEV stock, providing insights and strategies for both novice and seasoned investors.

The History of Global Energy Ventures (GEV)

Global Energy Ventures Ltd (GEV) was founded with the vision of revolutionizing the way natural gas is transported globally. The company focuses on the development and commercialization of compressed natural gas (CNG) marine transportation technology. The journey of GEV stock reflects the company’s efforts to innovate and expand in the energy transportation sector.

GEV’s pioneering approach to CNG transportation has positioned it as a key player in the energy market. By offering an alternative to traditional liquefied natural gas (LNG) and pipeline transportation methods, GEV aims to provide cost-effective and environmentally friendly solutions. The history of GEV stock is marked by strategic partnerships, technological advancements, and a commitment to sustainability.

Market Performance of GEV Stock

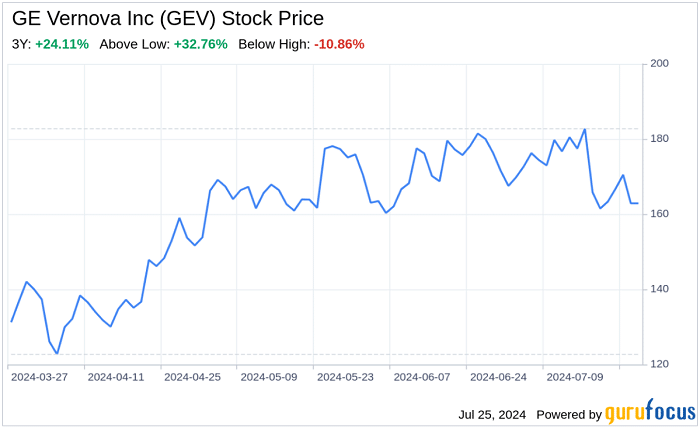

The market performance of GEV stock has been influenced by various factors, including technological advancements, regulatory changes, and market demand for natural gas. Analyzing the historical performance of GEV stock provides insights into how the company has navigated industry challenges and capitalized on opportunities.

Investors tracking GEV stock should consider both short-term fluctuations and long-term trends. Historical data, quarterly earnings reports, and market reactions to new developments are crucial for understanding the stock’s performance. By staying informed about these factors, investors can make more informed decisions about investing in GEV stock.

Key Factors Influencing GEV Stock

Several key factors influence the performance of GEV stock. These include the overall health of the energy sector, advancements in CNG technology, regulatory policies, and global demand for natural gas. Additionally, GEV’s ability to secure contracts and partnerships plays a significant role in its stock performance.

The competitive landscape also affects GEV stock. As new technologies and companies emerge in the energy transportation market, GEV must continuously innovate to maintain its competitive edge. Investors should monitor these factors to understand the potential risks and opportunities associated with GEV stock.

Investment Strategies for GEV Stock

Investing in GEV stock requires a strategic approach to maximize returns and manage risks. One effective strategy is to adopt a long-term investment perspective, betting on the growing demand for clean energy transportation. Diversifying your portfolio by including GEV stock alongside other energy and technology stocks can also help mitigate risks.

Another strategy involves staying updated on industry trends and company news. Regularly reviewing GEV’s financial statements, management updates, and market analyses can help investors make informed decisions about buying, holding, or selling GEV stock. Understanding the broader energy market and potential regulatory changes is also crucial for assessing the future potential of GEV stock.

The Role of Innovation in GEV’s Success

Innovation is at the core of GEV’s success and directly impacts GEV stock. The company’s focus on developing and commercializing CNG marine transportation technology sets it apart from traditional natural gas transportation methods. This innovative approach offers cost and environmental benefits, making GEV a compelling investment opportunity.

Investors should consider how GEV’s commitment to innovation can drive future growth. Technological advancements that improve efficiency, reduce costs, and enhance environmental sustainability can positively influence GEV stock. Additionally, GEV’s ability to adapt to market changes and leverage new technologies will be critical for its long-term success.

Comparing GEV Stock with Other Energy Stocks

When evaluating GEV stock, it is essential to compare it with other energy stocks in the market. Major players in the energy transportation sector, such as companies focused on LNG and pipeline transportation, offer different risk and return profiles. Understanding how GEV stock compares to these competitors can provide insights into its potential for growth and market share.

Factors to consider when comparing GEV stock with other energy stocks include technological capabilities, market positioning, financial performance, and strategic partnerships. By assessing these aspects, investors can better gauge GEV stock’s competitive advantages and potential challenges in the energy sector.

Environmental Impact and GEV Stock

The environmental impact of energy transportation is a significant consideration for investors interested in GEV stock. GEV’s focus on CNG transportation offers a more environmentally friendly alternative to traditional LNG and pipeline methods. This commitment to sustainability can enhance GEV’s market appeal and drive demand for its services.

Investors should evaluate how GEV’s environmental initiatives align with broader industry trends and regulatory policies. As governments and organizations increasingly prioritize sustainability, companies like GEV that offer green solutions may experience higher demand and better market performance. This alignment can positively influence GEV stock and its long-term growth prospects.

Future Prospects for GEV Stock

The future prospects for GEV stock are closely tied to the global energy landscape and the company’s ability to execute its strategic initiatives. As the world moves towards cleaner energy sources, the demand for efficient and sustainable natural gas transportation methods is expected to grow. GEV is well-positioned to capitalize on this trend with its innovative CNG technology.

Investors should consider the potential for GEV to expand its market presence, secure new contracts, and develop additional partnerships. Successful execution of these initiatives can drive revenue growth and enhance GEV stock’s value. Additionally, staying informed about industry trends, technological advancements, and regulatory changes will help investors anticipate opportunities and risks associated with GEV stock.

Conclusion:

Investing in GEV stock offers both opportunities and challenges. The company’s innovative approach to CNG transportation, commitment to sustainability, and potential for market expansion present significant growth potential. However, investors must also consider the competitive landscape, regulatory environment, and technological advancements that could impact GEV stock.

Ultimately, whether GEV stock is a good investment depends on individual risk tolerance, investment goals, and market outlook. By thoroughly researching GEV stock and staying updated on industry trends, investors can make informed decisions and potentially benefit from the growth of this promising company.

FAQs

1. What is GEV stock? GEV stock refers to shares in Global Energy Ventures Ltd (GEV), a company specializing in the transportation of compressed natural gas (CNG) via marine vessels.

2. How has GEV stock performed in the market? GEV stock has experienced fluctuating market performance influenced by factors such as technological advancements, regulatory changes, and global demand for natural gas.

3. What factors influence the performance of GEV stock? Key factors include the health of the energy sector, advancements in CNG technology, regulatory policies, and GEV’s ability to secure contracts and partnerships.

4. What investment strategies are effective for GEV stock? Effective strategies include adopting a long-term investment perspective, diversifying your portfolio, staying updated on industry trends, and regularly reviewing financial statements and market analyses.

5. What are the future prospects for GEV stock? Future prospects depend on GEV’s ability to grow its market presence, secure new contracts, leverage technological innovations, and align with environmental sustainability trends.