Introduction

LABU stock, or the Direxion Daily S&P Biotech Bull 3X Shares, is a leveraged exchange-traded fund (ETF) that aims to deliver three times the daily performance of the S&P Biotechnology Select Industry Index. Investing in LABU stock can be both rewarding and risky due to its leveraged nature. Understanding LABU stock is essential for investors looking to capitalize on the biotech sector’s growth.

Investing in LABU stock requires a solid understanding of how leveraged ETFs operate and the dynamics of the biotechnology sector. This guide will provide detailed insights into LABU stock, including its advantages, risks, and strategies for investing.

The Basics of LABU Stock

LABU stock is designed to amplify the daily returns of its underlying index, the S&P Biotechnology Select Industry Index, by a factor of three. This means that if the index increases by 1% on a given day, LABU stock aims to increase by 3%. Conversely, if the index decreases by 1%, LABU stock is likely to decrease by 3%.

Understanding the basics of LABU stock is crucial for investors who wish to take advantage of its leveraged exposure. It’s important to note that LABU stock is intended for short-term trading rather than long-term investing due to the compounding effects of daily leverage.

The Biotechnology Sector and LABU Stock

The biotechnology sector, represented by LABU stock, includes companies involved in the development and production of drugs, therapies, and medical technologies. This sector is known for its high growth potential, driven by advancements in medical research, increasing healthcare needs, and innovative treatments.

LABU stock provides investors with a way to gain amplified exposure to this dynamic and rapidly evolving sector. However, it’s important to recognize that the biotech sector is also highly volatile, with stock prices often reacting sharply to news about clinical trials, regulatory approvals, and technological breakthroughs.

Advantages of Investing in LABU Stock

Investing in LABU stock offers several advantages, particularly for those looking to capitalize on short-term market movements. The primary advantage is the potential for significant returns due to the stock’s leveraged nature. When the biotechnology sector performs well, LABU stock can deliver substantial gains.

Another advantage is the diversification provided by LABU stock. Instead of investing in individual biotech companies, investors gain exposure to a broad range of biotech firms through a single ETF. This diversification can help mitigate the risks associated with investing in individual stocks.

Risks Associated with LABU Stock

While LABU stock offers the potential for high returns, it also carries significant risks. The most notable risk is the amplified losses that can occur due to its leveraged structure. If the underlying index declines, LABU stock can experience substantial losses, which are magnified by the leverage factor.

Another risk is the volatility of the biotechnology sector itself. Biotech stocks can be highly unpredictable, with prices often influenced by external factors such as regulatory decisions and scientific advancements. This inherent volatility makes investing in LABU stock risky, particularly for those without a high risk tolerance.

Strategies for Investing in LABU Stock

Investing in LABU stock requires careful planning and a strategic approach. One common strategy is to use LABU stock for short-term trades, taking advantage of daily market movements. This approach involves closely monitoring the biotechnology sector and executing trades based on short-term trends and news.

Another strategy is to use LABU stock as part of a diversified portfolio. By combining LABU stock with other investments, investors can balance the potential for high returns with the need for stability and risk management. This approach requires a thorough understanding of both the biotech sector and the overall market.

Technical Analysis of LABU Stock

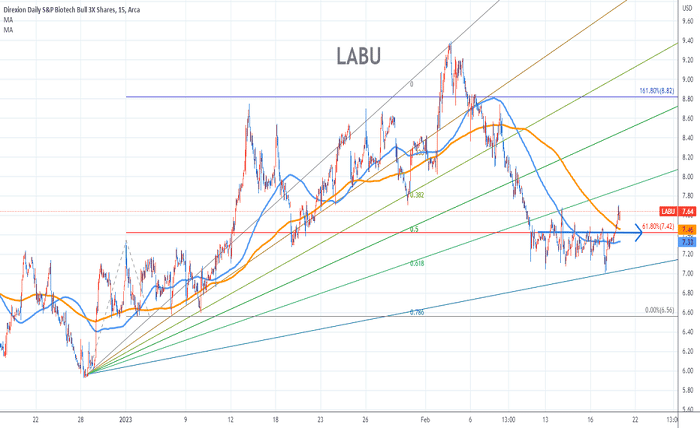

Technical analysis is a crucial tool for investors looking to trade LABU stock. By analyzing price charts, volume patterns, and technical indicators, traders can identify potential entry and exit points. Commonly used indicators for LABU stock include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Understanding technical analysis can help investors make informed decisions about when to buy or sell LABU stock. It’s important to combine technical analysis with fundamental research to develop a comprehensive trading strategy.

Fundamental Analysis of LABU Stock

Fundamental analysis involves evaluating the underlying factors that influence the performance of LABU stock. This includes analyzing the financial health and growth prospects of the biotechnology sector, as well as the economic and regulatory environment.

Key metrics to consider in fundamental analysis of LABU stock include earnings growth, revenue trends, and the pipeline of new drugs and treatments in development. By understanding these factors, investors can make more informed decisions about the long-term potential of LABU stock.

Market Trends and LABU Stock

Keeping abreast of market trends is essential for successfully trading LABU stock. This includes monitoring developments in the biotechnology sector, such as new drug approvals, mergers and acquisitions, and advances in medical technology. Additionally, broader market trends, such as economic indicators and interest rate changes, can also impact LABU stock.

Staying informed about market trends allows investors to anticipate potential movements in LABU stock and adjust their strategies accordingly. Utilizing financial news sources and market analysis tools can provide valuable insights into current and future trends.

Future Outlook for LABU Stock

The future outlook for LABU stock is closely tied to the growth and innovation within the biotechnology sector. As medical research continues to advance and new treatments are developed, the biotech sector is expected to see significant growth. This bodes well for LABU stock, which aims to capture and amplify these gains.

However, the future also holds uncertainties, including regulatory changes, competitive pressures, and market volatility. Investors should remain vigilant and adaptable, continuously reassessing their strategies based on the evolving landscape of the biotechnology sector and overall market conditions.

Conclusion:

In conclusion, LABU stock offers an exciting opportunity for investors looking to leverage the growth of the biotechnology sector. Its potential for high returns, coupled with the risks of amplified losses, makes it suitable for those with a high risk tolerance and a short-term trading horizon. By understanding the basics, analyzing market trends, and employing strategic approaches, investors can make informed decisions about whether LABU stock aligns with their investment goals.

Investing in LABU stock is not for everyone, but for those willing to take on the associated risks, it can be a rewarding addition to a diversified portfolio. As with any investment, thorough research and careful planning are key to success.

Stay updated with the latest nasikfatafat.org results. Discover how to check live results, winning strategies, and expert tips. Don’t miss out on your chance to win big in Nasik Fatafat!

FAQs

1. What is LABU stock? LABU stock is the Direxion Daily S&P Biotech Bull 3X Shares, a leveraged ETF designed to deliver three times the daily performance of the S&P Biotechnology Select Industry Index.

2. What are the advantages of investing in LABU stock? The primary advantages include the potential for high returns due to leverage and diversification across the biotechnology sector.

3. What are the risks associated with LABU stock? Risks include amplified losses due to leverage and the inherent volatility of the biotechnology sector.

4. How can I use technical analysis with LABU stock? Technical analysis involves using price charts and indicators like moving averages and RSI to identify trading opportunities and make informed decisions.

5. Is LABU stock suitable for long-term investment? LABU stock is generally intended for short-term trading rather than long-term investment due to its leveraged nature and daily compounding effects.

Explore trendzgurujime.org , your go-to platform for the latest trends in technology, entertainment, and lifestyle. Stay updated with expert insights, tips, and trending news all in one place.