TMF Stock: Analyzing, and Investing

Introduction

TMF stock, represented by the Direxion Daily 20+ Year Treasury Bull 3X Shares ETF, is an intriguing option for investors seeking leveraged exposure to U.S. Treasury bonds. Understanding the intricacies of TMF stock, its performance, and potential benefits is crucial for making informed investment decisions. This comprehensive guide will delve into various aspects of TMF stock, providing insights and strategies for investors.

What is TMF Stock?

TMF stock refers to the Direxion Daily 20+ Year Treasury Bull 3X Shares ETF. This exchange-traded fund aims to provide 300% of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. TMF stock is designed for short-term trading and is not suitable for long-term investments due to its leveraged nature.

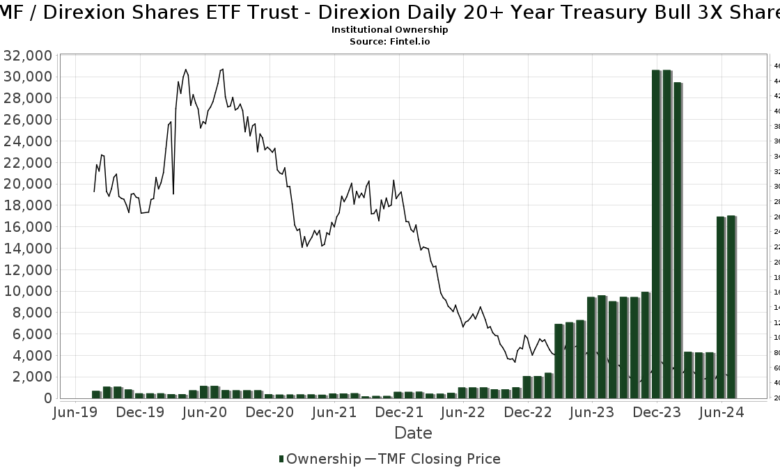

Historical Performance of TMF Stock

The historical performance of TMF stock has been characterized by significant volatility. As a leveraged ETF, TMF stock amplifies the movements of its underlying index, leading to substantial price fluctuations. Investors can review historical data to understand how TMF stock has responded to various market conditions and economic events.

Analyzing TMF Stock on Financial Platforms

Financial platforms like Yahoo Finance, Bloomberg, and Morningstar offer detailed analyses of TMF stock. These platforms provide real-time quotes, historical performance charts, financial ratios, and expert opinions. Utilizing these resources can help investors make well-informed decisions regarding TMF stock.

The Role of U.S. Treasury Bonds in TMF Stock

TMF stock is directly linked to U.S. Treasury bonds, specifically those with maturities of 20 years or more. Understanding the dynamics of U.S. Treasury bonds, including interest rate movements and economic factors, is crucial for analyzing TMF stock. The performance of TMF stock is heavily influenced by changes in interest rates and bond yields.

Risks Associated with Investing in TMF Stock

Investing in TMF stock carries several risks, primarily due to its leveraged nature. The stock is designed for short-term trading and can result in significant losses if held for extended periods. Investors must be aware of the risks associated with leveraged ETFs and employ strategies to mitigate potential losses.

Benefits of Investing in TMF Stock

Despite its risks, TMF stock offers several benefits for traders. It provides leveraged exposure to U.S. Treasury bonds, allowing for amplified returns during periods of favorable market conditions. TMF stock can be an effective tool for traders seeking short-term gains and those looking to hedge against certain market risks.

Strategies for Trading TMF Stock

Trading TMF stock requires a strategic approach due to its high volatility. Some effective strategies include:

- Short-Term Trading: Capitalize on short-term price movements to achieve quick gains.

- Technical Analysis: Use charts and indicators to identify trading opportunities.

- Risk Management: Implement stop-loss orders to limit potential losses.

- Diversification: Combine TMF stock with other assets to reduce overall portfolio risk.

Leveraged ETFs and TMF Stock

TMF stock is a leveraged ETF, meaning it uses financial derivatives and debt to amplify the returns of its underlying index. Leveraged ETFs like TMF stock are designed for experienced traders who understand the complexities and risks of such investment products. Proper knowledge and caution are essential when trading TMF stock.

Market Conditions Impacting TMF Stock

Various market conditions can significantly impact the performance of TMF stock. Interest rate changes, economic data releases, and geopolitical events are some factors that influence U.S. Treasury bonds and, consequently, TMF stock. Staying updated with market news and trends is crucial for successful trading.

Comparing TMF Stock with Other Investment Options

Comparing TMF stock with other investment options, such as traditional ETFs, bonds, and stocks, can help investors determine its suitability for their portfolios. While TMF stock offers the potential for high returns, its risks and volatility must be carefully considered against more stable investment choices.

The Future Outlook for TMF Stock

The future outlook for TMF stock depends on several factors, including interest rate trends, economic conditions, and investor sentiment. Analysts and financial experts provide various projections for TMF stock, helping investors form expectations and strategies. Staying informed about these projections can guide investment decisions.

Conclusion

TMF stock presents a unique opportunity for investors seeking leveraged exposure to U.S. Treasury bonds. Understanding its historical performance, risks, benefits, and trading strategies is essential for making informed decisions. By leveraging financial platforms and staying updated with market conditions, investors can navigate the complexities of TMF stock and potentially achieve significant returns.

FAQs

Q1: What is TMF stock?

A1: TMF stock refers to the Direxion Daily 20+ Year Treasury Bull 3X Shares ETF, which aims to provide 300% of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

Q2: How does the historical performance of TMF stock look?

A2: The historical performance of TMF stock is characterized by significant volatility due to its leveraged nature, with substantial price fluctuations based on market conditions.

Q3: What are the risks associated with investing in TMF stock?

A3: Investing in TMF stock involves risks such as high volatility, potential for significant losses, and the complexities associated with leveraged ETFs. It is designed for short-term trading.

Q4: What strategies can be used for trading TMF stock?

A4: Effective strategies for trading TMF stock include short-term trading, technical analysis, risk management with stop-loss orders, and portfolio diversification.

Q5: How does the performance of U.S. Treasury bonds impact TMF stock?

A5: The performance of TMF stock is heavily influenced by U.S. Treasury bonds, especially those with maturities of 20 years or more, with interest rate changes and economic factors playing crucial roles.