FNGU Stock: A Comprehensive Guide for Potential Investors

Introduction

FNGU stock represents the MicroSectors FANG+ Index 3X Leveraged ETN, a financial instrument designed to provide triple the daily performance of the NYSE FANG+ Index. This index includes 10 highly traded technology and internet stocks, such as Facebook (Meta), Amazon, Netflix, and Google (Alphabet). FNGU stock appeals to investors looking for leveraged exposure to some of the most dynamic companies in the tech sector.

FNGU stock offers an intriguing opportunity for those seeking to amplify their returns. However, with higher potential rewards come higher risks, making it essential for investors to fully understand the intricacies of FNGU stock before adding it to their portfolios. This blog will delve into the details of FNGU stock, including its origins, performance, risks, and future prospects.

The Origins of FNGU Stock

The inception of FNGU stock is tied to the growing interest in technology and internet-based companies. The NYSE FANG+ Index, which FNGU stock aims to track, includes leading tech giants known for their significant impact on the market. Launched by MicroSectors, FNGU stock was created to offer leveraged exposure to this index, providing investors with a tool to potentially enhance their returns.

FNGU stock was introduced to meet the demands of investors looking for amplified gains from their investments in tech stocks. By leveraging the daily performance of the FANG+ Index, FNGU stock allows for greater profit potential, albeit with increased volatility and risk. This leveraged ETN has become a popular choice for those looking to capitalize on the rapid growth of the technology sector.

Leveraged ETFs and ETNs

FNGU stock is classified as a leveraged ETN (Exchange-Traded Note), which differs from traditional ETFs (Exchange-Traded Funds) in several key ways. Leveraged ETNs like FNGU stock are debt instruments issued by financial institutions, designed to provide a multiple of the daily returns of a specific index. In the case of FNGU stock, this multiple is three times the daily performance of the NYSE FANG+ Index.

Leveraged ETNs, including FNGU stock, do not hold physical assets but rather use derivatives to achieve their leverage. This structure allows for significant potential gains but also introduces greater complexity and risk. Investors in FNGU stock must understand these nuances to effectively manage their investments and mitigate potential downsides.

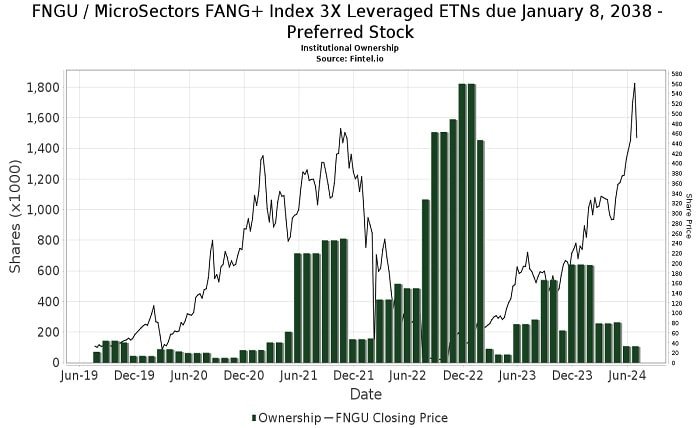

The Performance of FNGU Stock

The performance of FNGU stock is closely tied to the movements of the NYSE FANG+ Index. As a leveraged ETN, FNGU stock aims to deliver three times the daily returns of this index. This leverage can result in substantial gains during periods of positive performance, but it also means that losses can be magnified during downturns.

Historically, FNGU stock has shown impressive gains during bullish periods for technology stocks. For example, during market rallies driven by strong earnings reports and technological advancements, FNGU stock has outperformed traditional ETFs tracking the same index. However, during market corrections or downturns, FNGU stock can experience significant volatility and steep declines.

Risks Associated with FNGU Stock

Investing in FNGU stock comes with inherent risks that investors must carefully consider. The primary risk is the leveraged nature of the ETN, which can amplify both gains and losses. Due to this leverage, small percentage changes in the underlying index can lead to large swings in the value of FNGU stock.

Another risk factor for FNGU stock is the daily reset mechanism. Leveraged ETNs are designed to achieve their stated multiple on a daily basis, which can lead to a phenomenon known as “compounding risk” over longer periods. This means that the performance of FNGU stock over time may diverge significantly from three times the cumulative performance of the NYSE FANG+ Index.

Strategies for Investing in FNGU Stock

Investing in FNGU stock requires a strategic approach to manage the risks and maximize the potential rewards. One common strategy is to use FNGU stock as a short-term trading vehicle rather than a long-term investment. By focusing on shorter time frames, investors can capitalize on the leveraged returns while mitigating the impact of compounding risk.

Another strategy involves closely monitoring market conditions and the performance of the underlying FANG+ stocks. Investors in FNGU stock should stay informed about earnings reports, technological developments, and broader market trends that can influence the index. Timing entries and exits based on these factors can help optimize returns and reduce exposure to volatility.

Comparing FNGU Stock with Other Tech Investments

When considering FNGU stock, it is essential to compare it with other tech investment options. Traditional tech ETFs, individual tech stocks, and other leveraged instruments all offer different risk-reward profiles. FNGU stock stands out for its ability to provide leveraged exposure to a basket of leading tech companies, which can be advantageous during bullish market conditions.

Compared to individual tech stocks, FNGU stock offers diversification across multiple high-growth companies, reducing the impact of poor performance by any single stock. However, the leveraged nature of FNGU stock introduces higher volatility compared to traditional tech ETFs, making it more suitable for investors with a higher risk tolerance and shorter investment horizons.

The Impact of Market Conditions on FNGU Stock

Market conditions play a crucial role in the performance of FNGU stock. During periods of strong economic growth and positive sentiment towards technology stocks, FNGU stock can deliver substantial gains. Conversely, during market downturns or periods of uncertainty, the leveraged nature of FNGU stock can lead to significant losses.

Investors in FNGU stock should pay close attention to macroeconomic indicators, interest rate trends, and sector-specific news that can influence market sentiment. By staying attuned to these factors, investors can better navigate the volatility associated with FNGU stock and make informed decisions about their investment timing and position sizing.

Future Prospects for FNGU Stock

The future prospects for FNGU stock are closely linked to the performance of the underlying technology and internet companies in the NYSE FANG+ Index. As long as these companies continue to innovate and grow, FNGU stock has the potential to deliver strong returns. Technological advancements, increased digital adoption, and robust earnings growth can all contribute to the positive outlook for FNGU stock.

However, investors should also consider potential headwinds, such as regulatory challenges, market saturation, and macroeconomic uncertainties that could impact the tech sector. By staying informed about these dynamics and regularly reassessing their investment thesis, investors can better position themselves to capitalize on the opportunities presented by FNGU stock.

Conclusion

FNGU stock offers a unique opportunity for investors seeking leveraged exposure to some of the most influential technology and internet companies. With its potential for amplified returns, FNGU stock can be an attractive addition to a diversified investment portfolio, particularly for those with a higher risk tolerance and a focus on short-term trading.

However, the leveraged nature of FNGU stock also introduces significant risks that investors must carefully manage. Understanding the origins, characteristics, and performance of FNGU stock, as well as employing strategic investment approaches, is crucial for navigating this complex and dynamic investment vehicle.

As technology continues to shape the future of the global economy, FNGU stock represents a way to participate in the growth of leading tech companies while leveraging potential gains. By staying informed and strategically managing their investments, investors can harness the potential of FNGU stock to achieve their financial goals.

FAQs

1. What is FNGU stock? FNGU stock is the MicroSectors FANG+ Index 3X Leveraged ETN, providing triple the daily performance of the NYSE FANG+ Index.

2. How does FNGU stock work? FNGU stock uses leverage to amplify the daily returns of the NYSE FANG+ Index, aiming to deliver three times the index’s performance, both gains and losses.

3. What are the risks of investing in FNGU stock? Risks include amplified volatility due to leverage, compounding risk from daily resets, and potential significant losses during market downturns.

4. How should investors approach FNGU stock? Investors should consider FNGU stock for short-term trading, closely monitor market conditions, and use it as part of a diversified investment strategy.

5. What factors influence the performance of FNGU stock? The performance of FNGU stock is influenced by the underlying FANG+ companies’ performance, broader market conditions, economic indicators, and technological trends.