Mastering Forex Tracking: A Comprehensive Guide for Traders

Introduction

Forex tracking is a crucial aspect of successful currency trading. By monitoring and analyzing your trades, you can make informed decisions, optimize your strategies, and achieve better outcomes. In this comprehensive guide, we will explore everything you need to know about forex tracking, from its importance to the best tools and techniques.

What is Forex Tracking?

Forex tracking involves the systematic monitoring and analysis of forex trades. It includes keeping records of your trading activities, tracking market movements, and analyzing performance metrics. Effective forex tracking helps traders understand their trading patterns, identify strengths and weaknesses, and refine their strategies.

The Importance of Forex Tracking

Forex tracking is essential for several reasons. It helps traders maintain discipline, make data-driven decisions, and improve their trading performance over time. By keeping detailed records, traders can review their trades, learn from past mistakes, and replicate successful strategies. This continuous improvement is vital for long-term success in forex trading.

Tools for Forex Tracking

There are various tools available for forex tracking, ranging from simple spreadsheets to advanced trading platforms. Popular tools include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and various online forex tracking software. These tools offer features such as trade logging, performance analysis, and real-time market data, making them indispensable for serious traders.

Techniques for Effective Forex Tracking

Effective forex tracking requires a systematic approach. This includes setting up a consistent method for recording trades, categorizing them by strategy, and analyzing key performance indicators (KPIs) such as win rate, risk-reward ratio, and average profit/loss. This section will outline techniques for maintaining comprehensive and organized forex tracking records.

Creating a Forex Trading Journal

A forex trading journal is a vital tool for forex tracking. It allows traders to document each trade, including entry and exit points, trade size, and the rationale behind the trade. By regularly updating and reviewing the journal, traders can gain insights into their trading behavior and make necessary adjustments to their strategies.

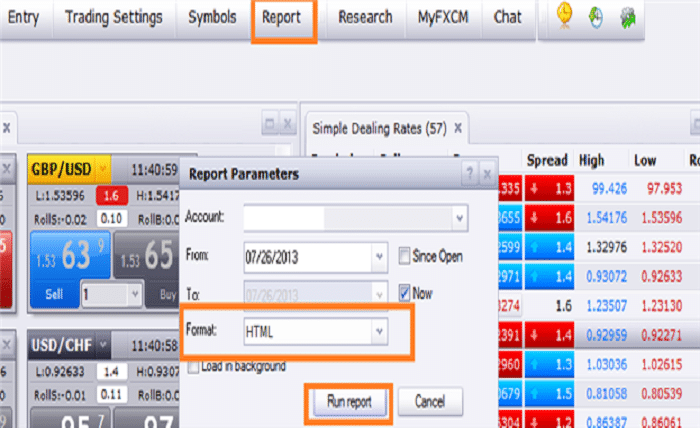

Using Forex Tracking Software

Forex tracking software can automate many aspects of trade tracking, making the process more efficient and accurate. These software solutions often include features like automated trade logging, performance dashboards, and advanced analytics. This section will discuss the benefits of using forex tracking software and recommend some popular options.

Analyzing Forex Tracking Data

Analyzing the data collected through forex tracking is crucial for improving trading performance. Traders should regularly review their trading journal and software reports to identify patterns and trends. This analysis can reveal which strategies are working, which need improvement, and how external factors are impacting trades.

Strategies for Improving Forex Tracking

Improving forex tracking involves adopting best practices and staying disciplined. This includes setting clear goals, regularly updating your trading journal, and using technology to streamline the tracking process. This section will offer strategies for enhancing your forex tracking efforts to achieve better trading results.

Common Mistakes in Forex Tracking

Even experienced traders can make mistakes in forex tracking. Common errors include inconsistent record-keeping, failing to analyze performance data, and not using available tools effectively. This section will highlight these mistakes and provide tips on how to avoid them, ensuring more accurate and useful tracking.

The Future of Forex Tracking

The future of forex tracking is likely to be shaped by advancements in technology, such as artificial intelligence (AI) and machine learning. These technologies can provide deeper insights and more accurate predictions, helping traders refine their strategies. This section will explore how these emerging trends might impact forex tracking in the coming years.

Conclusion

Forex tracking is an indispensable part of successful trading. By systematically monitoring and analyzing trades, traders can make informed decisions, improve their strategies, and achieve better results. Whether using simple spreadsheets or advanced software, the key to effective forex tracking lies in consistency and thoroughness. This comprehensive guide aims to provide traders with the knowledge and tools needed to master forex tracking and enhance their trading performance.

FAQs

- What is forex tracking? Forex tracking involves monitoring and analyzing forex trades to understand trading patterns, identify strengths and weaknesses, and refine trading strategies.

- Why is forex tracking important? Forex tracking is important because it helps traders maintain discipline, make data-driven decisions, and continuously improve their trading performance over time.

- What tools can I use for forex tracking? Tools for forex tracking include MetaTrader 4 (MT4), MetaTrader 5 (MT5), online forex tracking software, and spreadsheets. These tools help with trade logging, performance analysis, and real-time market data.

- How can I create an effective forex trading journal? An effective forex trading journal should document each trade, including entry and exit points, trade size, and rationale. Regularly updating and reviewing the journal helps traders gain insights and make necessary adjustments to their strategies.

- What are common mistakes in forex tracking? Common mistakes in forex tracking include inconsistent record-keeping, failing to analyze performance data, and not using available tools effectively. Avoiding these mistakes ensures more accurate and useful tracking.