Webull Cash Management: A Comprehensive Guide

Introduction

Webull Cash Management is an attractive feature for investors looking to maximize their cash reserves. This service offers a unique blend of high interest rates and liquidity, making it a valuable tool for both novice and experienced investors. In this comprehensive guide, we’ll explore the ins and outs of Webull Cash Management, including its benefits, how to set up an account, associated fees, and tips for getting the most out of this service.

What is Webull Cash Management?

Webull Cash Management is a service that allows investors to earn interest on their uninvested cash. This service seamlessly integrates with Webull’s brokerage accounts, providing users with a convenient way to grow their cash holdings while maintaining easy access to their funds. With competitive interest rates and no minimum balance requirements, Webull Cash Management is designed to optimize the way you manage your cash.

Benefits of Webull Cash Management

One of the primary benefits of Webull Cash Management is the high-interest rates offered on idle cash. Unlike traditional savings accounts, Webull provides a significantly higher return on your uninvested funds. Additionally, the service offers FDIC insurance protection up to $1.25 million, ensuring your money is safe. Furthermore, Webull Cash Management accounts provide instant liquidity, allowing you to access your funds whenever you need them.

How to Set Up a Webull Cash Management Account

Setting up a Webull Cash Management account is straightforward. If you already have a Webull brokerage account, you can easily opt into the Cash Management service through the app or website. New users will need to create a Webull account and complete the verification process before enrolling in Cash Management. The entire process is user-friendly and can be completed within minutes.

Interest Rates and Earnings Potential

Webull Cash Management offers competitive interest rates that can significantly enhance your earnings potential. The interest rates are often higher than those offered by traditional banks, making it an attractive option for investors looking to maximize their cash returns. Interest is compounded daily and credited monthly, allowing your money to grow more efficiently over time.

FDIC Insurance and Security

Security is a top priority for Webull, and their Cash Management accounts are no exception. Funds in Webull Cash Management accounts are eligible for FDIC insurance through program banks, up to $1.25 million per depositor. This insurance provides peace of mind, knowing that your cash is protected against bank failures. Additionally, Webull employs advanced security measures to safeguard your account information and transactions.

Comparing Webull Cash Management to Other Services

When compared to other cash management services, Webull stands out due to its high interest rates and lack of fees. Many traditional banks and financial institutions offer lower interest rates and may charge maintenance fees or require minimum balances. Webull Cash Management eliminates these hurdles, providing a more efficient and cost-effective way to manage your idle cash.

How to Access Your Funds

One of the standout features of Webull Cash Management is the ease of access to your funds. Users can transfer money between their Cash Management account and their Webull brokerage account with just a few clicks. This instant access ensures that you can quickly move funds when investment opportunities arise or when you need to cover expenses.

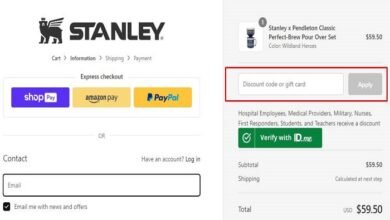

Fees and Costs Associated with Webull Cash Management

Webull Cash Management is designed to be cost-effective for investors. There are no maintenance fees, minimum balance requirements, or transaction fees associated with the service. This fee-free structure makes it easier for users to maximize their earnings without worrying about hidden costs eating into their returns.

How to Maximize Your Earnings with Webull Cash Management

To get the most out of Webull Cash Management, it’s essential to keep your funds actively earning interest. Regularly review your account to ensure that any idle cash is transferred to your Cash Management account. Additionally, take advantage of the high interest rates by keeping as much of your uninvested cash in the account as possible.

Integration with Webull Brokerage Accounts

Webull Cash Management seamlessly integrates with Webull brokerage accounts, offering a streamlined experience for users. This integration allows for easy transfers between accounts, enabling you to quickly move funds as needed. The unified platform ensures that managing your investments and cash reserves is as efficient as possible.

User Experience and Mobile App Features

The Webull app offers a user-friendly experience, making it easy to manage your Cash Management account on the go. The app provides real-time updates on your account balance, interest earned, and transaction history. With intuitive navigation and robust features, the Webull app ensures that you can effectively manage your finances from anywhere.

Tips for New Users

If you’re new to Webull Cash Management, here are a few tips to help you get started:

- Explore the Features: Take time to familiarize yourself with the various features of Webull Cash Management, including how to transfer funds and monitor your interest earnings.

- Keep Funds Active: Regularly review your account to ensure that your cash is actively earning interest.

- Utilize the App: Make full use of the Webull app to manage your account on the go and stay informed about your earnings and transactions.

- Stay Informed: Keep an eye on updates from Webull, as they may periodically adjust interest rates or introduce new features that could benefit you.

Conclusion

Webull Cash Management is a powerful tool for investors looking to optimize their cash reserves. With high interest rates, FDIC insurance, and seamless integration with Webull brokerage accounts, this service offers a comprehensive solution for managing your idle cash. By following the tips and information provided in this guide, you can maximize your earnings and make the most of Webull Cash Management.

FAQs

1. What is the interest rate for Webull Cash Management?

The interest rate for Webull Cash Management varies but is generally higher than traditional savings accounts. It is important to check Webull’s website or app for the current rate.

2. How do I transfer funds to my Webull Cash Management account?

You can transfer funds to your Webull Cash Management account through the Webull app or website by linking your bank account and initiating a transfer.

3. Is there a minimum balance requirement for Webull Cash Management?

No, Webull Cash Management does not have a minimum balance requirement, making it accessible for all investors.

4. Are there any fees associated with Webull Cash Management?

Webull Cash Management does not charge any maintenance fees, minimum balance fees, or transaction fees, allowing you to maximize your earnings.

5. How is my money protected in a Webull Cash Management account?

Funds in Webull Cash Management accounts are protected by FDIC insurance through program banks, up to $1.25 million per depositor, ensuring the safety of your money.