Yahoo Finance GME Phenomenon: An In-Depth Analysis

Introduction

The “Yahoo Finance GME” phenomenon has captivated investors, analysts, and the general public alike. This blog post delves deep into the intricate details of GameStop (GME) and how Yahoo Finance has become a pivotal platform for tracking its volatile journey. From the stock’s meteoric rise and fall to its impact on market dynamics, we cover everything you need to know.

The Origins of GameStop (GME)

GameStop (GME) was founded in 1984 and quickly grew into a leading video game, consumer electronics, and gaming merchandise retailer. Despite facing financial struggles in recent years, the stock saw unprecedented attention in 2021. Yahoo Finance became the go-to source for investors looking to track GME’s stock movements.

The Role of Yahoo Finance in Stock Tracking

Yahoo Finance provides comprehensive financial news, data, and commentary, making it an essential tool for investors. Its detailed tracking of GME’s stock allowed users to access real-time updates, historical data, and expert analysis, becoming central to the “Yahoo Finance GME” narrative.

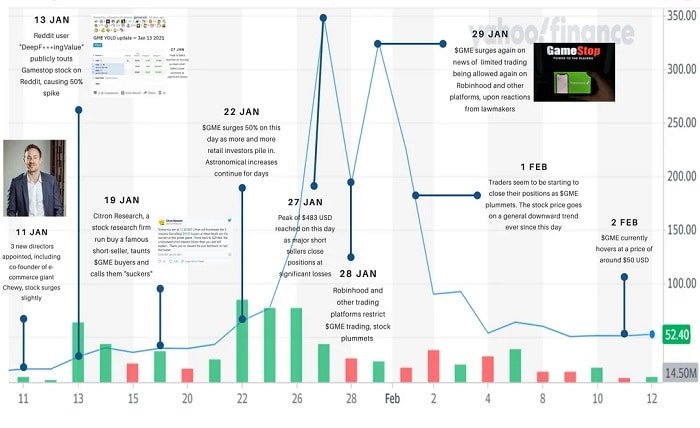

The Reddit Revolution: r/WallStreetBets and GME

The r/WallStreetBets subreddit played a crucial role in GME’s stock surge. Investors used Yahoo Finance to monitor GME’s performance, contributing to the “Yahoo Finance GME” phenomenon. The coordinated buying frenzy led to a short squeeze, skyrocketing the stock price.

The Short Squeeze

A short squeeze occurs when a heavily shorted stock’s price increases sharply, forcing short sellers to buy shares to cover their positions. This exacerbates the stock price rise, as seen in GME’s case. Yahoo Finance provided the necessary data for investors to stay informed during this volatile period.

Impact on Retail Investors

Retail investors played a pivotal role in the “Yahoo Finance GME” saga. Many turned to Yahoo Finance for real-time updates and insights, allowing them to make informed decisions. The platform’s accessibility and comprehensive data proved invaluable during the GME frenzy.

GameStop’s Financial Health

Analyzing GME’s financial health became a focus for investors. Yahoo Finance offered detailed financial statements, earnings reports, and analyst ratings, helping investors understand the company’s fundamentals amid the stock’s volatile movements.

The Legal and Regulatory Response

The “Yahoo Finance GME” phenomenon drew attention from regulatory bodies. Investigations were launched to understand the market manipulation claims. Yahoo Finance reported extensively on these developments, keeping investors informed about potential legal implications.

Media Coverage and Public Perception

The media played a significant role in shaping public perception of the GME phenomenon. Yahoo Finance’s coverage provided a balanced view, offering expert opinions, investor sentiment, and detailed analysis of the unfolding events.

Long-Term Implications for GameStop

While the “Yahoo Finance GME” saga brought short-term gains for some investors, the long-term implications for GameStop remain uncertain. Yahoo Finance continues to provide updates on GME’s performance, helping investors navigate the stock’s future prospects.

Lessons Learned from the GME Frenzy

The “Yahoo Finance GME” phenomenon taught investors several lessons about market dynamics, the power of social media, and the importance of due diligence. Yahoo Finance remains a crucial resource for those looking to learn from the GME experience.

Comparing GME with Other Meme Stocks

GameStop isn’t the only stock that experienced a surge due to retail investor interest. Yahoo Finance provides comparisons with other meme stocks, helping investors understand the broader trend and its implications on the market.

The Future of Retail Investing

The “Yahoo Finance GME” phenomenon has reshaped retail investing. More investors are turning to platforms like Yahoo Finance for real-time data, expert analysis, and community insights. This trend is likely to continue, influencing future market movements.

Conclusion

The “Yahoo Finance GME” phenomenon represents a unique moment in financial history. It highlighted the power of retail investors, the impact of social media, and the critical role of platforms like Yahoo Finance. As we move forward, the lessons learned from GME will continue to shape investment strategies and market dynamics.

FAQs

1. What caused the GME stock surge? The GME stock surge was primarily caused by a coordinated effort by retail investors on the r/WallStreetBets subreddit, leading to a short squeeze.

2. How did Yahoo Finance help investors during the GME surge? Yahoo Finance provided real-time updates, historical data, financial statements, and expert analysis, helping investors make informed decisions.

3. What is a short squeeze? A short squeeze occurs when a heavily shorted stock’s price rises sharply, forcing short sellers to buy shares to cover their positions, further driving up the stock price.

4. What are the long-term implications of the GME phenomenon for GameStop? The long-term implications for GameStop remain uncertain, with continued volatility expected. Yahoo Finance provides ongoing updates to help investors understand GME’s future prospects.

5. How has the GME phenomenon impacted retail investing? The GME phenomenon has increased the influence of retail investors and highlighted the importance of accessible financial data and analysis platforms like Yahoo Finance.